missoula property tax increase

Missoula County Community and Planning Services. Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020.

Carefully determine your actual tax applying any exemptions that you are qualified to utilize.

. Missoula County Animal Control. Missoula County Administration Building. In fact if you took that homes property taxes in 2016 and applied the national average property tax increase.

MIssoula County Grants Community Programs. Missoula City-County Health Department. Find Information On Any Missoula County Property.

Missoula County Courthouse Annex. The cost of providing services through local government increases faster than our ability to pay for those costs said. The tax jump comes as a result of inflation and the citys decision not to raise property taxes over the past two years due to the.

093 of home value. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes. Thats more than double the rate of the house with the smallest increase in our analysis house three.

Yearly median tax in Missoula County. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. You are visitor 5042247.

In the court you better solicit for help from one of. If you are sending your payments in by mail address them To. Thursday August 11th 2022.

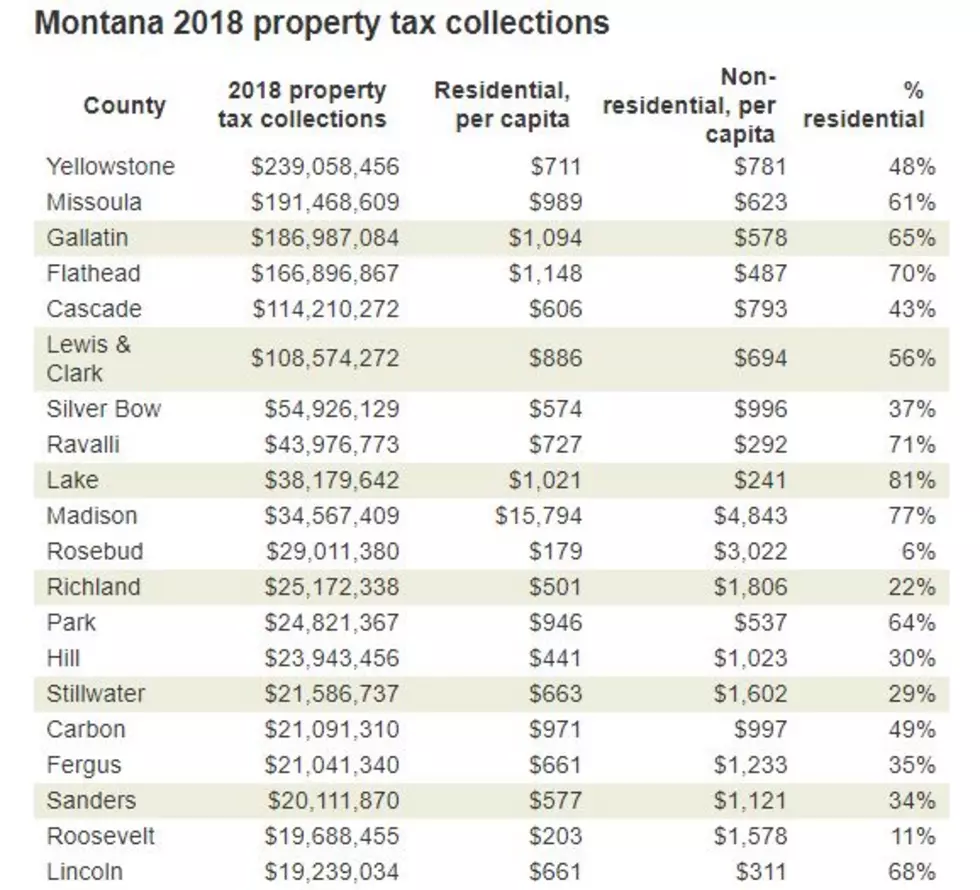

Missoula County Detention Center. The City of Missoula accounts for roughly 304 of a property owners tax bill while the county represents around 219. Missoula County has one of the highest median property taxes in the United.

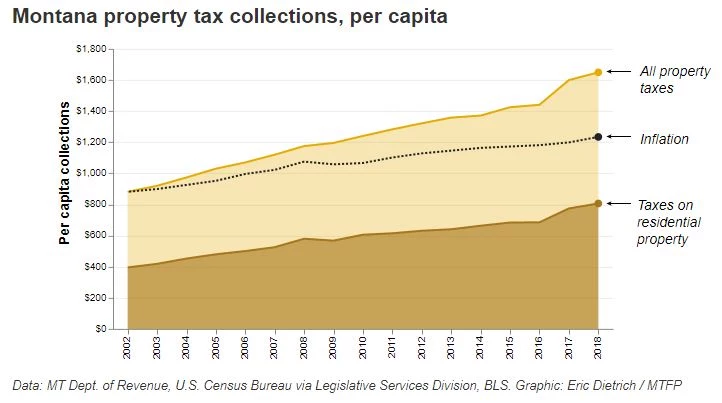

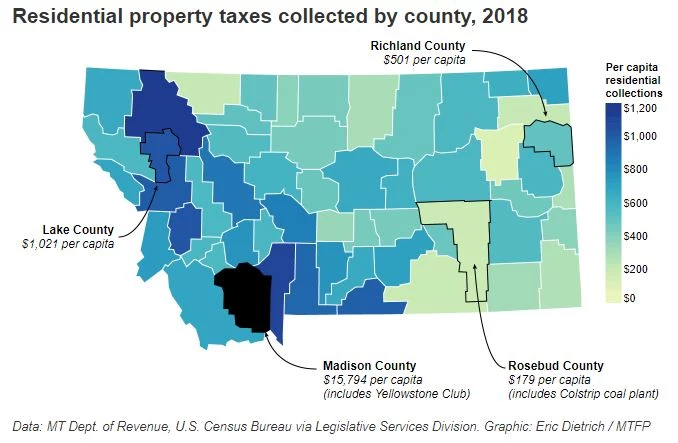

The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs relating to equity affordable housing criminal justice reform and sustainability. These increases are considerably higher than Montanas average yearly property tax increase of 5 and drastically higher than the national yearly property tax increase average of roughly 32. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

The report found that the average yearly increase in each homes property taxes from 2016 to 2020 were 74 8 and 65. Missoula taxes set to increase almost 12 under new budget. The county is set to adopt the budget on Tuesday.

While it may seem small a few. Ad Find Missoula County Online Property Taxes Info From 2022. What appears to be a large increase in value may actually turn into a modest increase in your property tax bill.

Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. The notices for the 2019-2020 appraisal cycle are. Missoula County collects on average 093 of a propertys assessed fair market value as property tax.

The city unveiled Mayor John Engens proposed 2023 budget Wednesday morning in a committee meeting setting forth an 1159 tax and assessment increase for Missoula property owners. City of Missoula announced new property valuations from the Montana. County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved bonds.

The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. Missoula announces new property valuations 11 projected tax increase.

Missoula County Tax Values Come In High Property Owners Likely To Save

Montana Legislative Committee Opposes Measure To Cap Residential Property Taxes

Graduated Rates Would Provide Tax Relief Shrink Deficits And Boost The Illinois Economy The Illinois Update

Montana Property Taxes Keep Rising But Missoula Isn T At The Top

With Skyrocketing Property Values Homeowners See Rapid Increase In Taxes Keci

Montana Property Taxes Keep Rising But Missoula Isn T At The Top

Having The Facts About Values In Your Neighborhood Will Let You Know If Your Assessment Is Too High Assessment The Neighbourhood Facts

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Montana Property Taxes Keep Rising But Missoula Isn T At The Top

Graduated Rates Would Provide Tax Relief Shrink Deficits And Boost The Illinois Economy The Illinois Update

Montana Property Taxes Keep Rising But Missoula Isn T At The Top